additional tax assessed by examination

Exploring Tax Audit Selection. Is the agreement form to be used in two situations.

Assessment of additional tax.

. An Examination and Audit. The following is an example of a case law which defines an additional assessment. For example the IRS uses random sampling information comparison and computerized screening to select returns for audits.

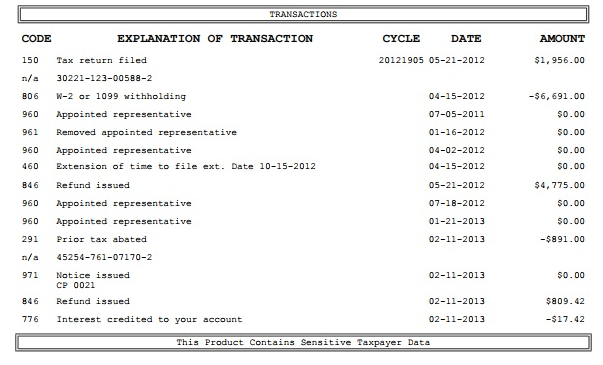

Examination by department of returns other information Assessment of additional tax interest. 442513 Follow-up on Quick Assessment Form 3210 CCP or Campus Examination Procedures. TC 420 Examination Indicator reflects that a return is under examination consideration though the return may or may not ultimately be audited.

If a taxpayer files a return before the filing date for example a Form 1040 filed on April 12th for. And the IRS can also file a potential tax lien or levy on the taxpayers account which can result on the IRS seizing the taxpayers assets such as a car or other property or garnishment of the taxpayers wages through their employer. 4425141 Follow-up on Form 3552.

Assessment of additional tax. Possibly you left income off your return that was reported to IRS. 575 rows Additional tax assessed by examination.

Complete the following sentences by clicking on the correct answer. Continue to Part 2 or to assess your answers click the Check My Answers button at the bottom of the page. 442515 Second Adjustment Document Form 5344 or Form 5403 CCP Responsibility.

Section 5449-6 - Examination of return report. I was accepted 210 and no change or following messages on Transcript since. If you see TC 420 Examination of tax return on your account transcript it doesnt necessarily mean youll be audited.

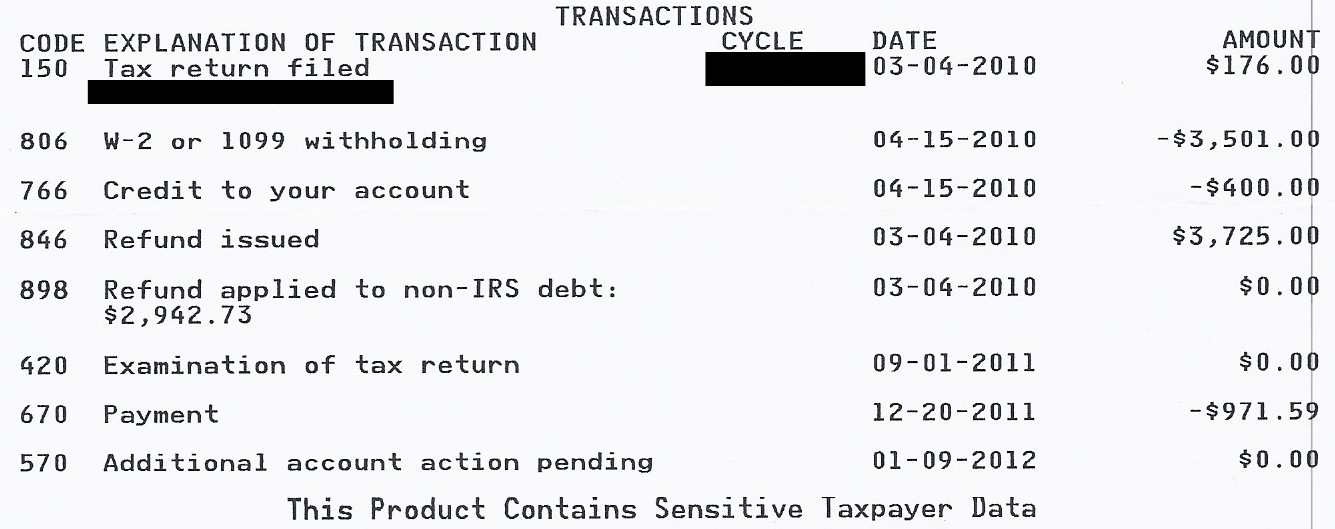

Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan. Every year the IRS selects millions of returns for examination but audits only a fraction of those selected. After a return or report is filed under the provisions of any State tax law the director shall cause the same to be examined and may make such further audit or investigation as he may deem necessary and if therefrom he shall determine that there is a deficiency with respect to the payment of any tax due under such law he shall assess the additional taxes penalties if any.

TC 291 Abatement Prior Tax Assessment. TC 428 Examination or Appeals Case Transfer. When the IRS selects a tax return for further study it carries out an.

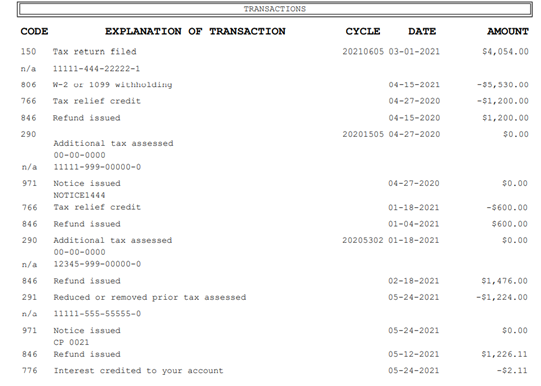

Additional Tax or Deficiency Assessment. Code 290 Additional Tax Assessed on transcript following filing in Jan. Once the tax is assessed in determining any additional.

TC 300 Additional Tax or Deficiency Assessment by Examination Division or Collection Division. NJ Rev Stat 5449-6 2021 5449-6. The IRS relies on a combination of random selection and specific triggers to flag tax returns that they believe.

1 If upon examination of any returns or from other information obtained by the department it appears that a tax or penalty has been paid less than that properly due the department shall assess against the taxpayer an additional amount found to be due and shall. Your Role as a Taxpayer. Just sitting in received.

After a return or report is filed under the provisions of any State tax law the director shall cause the same to be examined and may make such. Agreement to Assessment and Collection of Additional Tax and Acceptance of Overassessment. The discriminant function system is a computerized system used by the IRS.

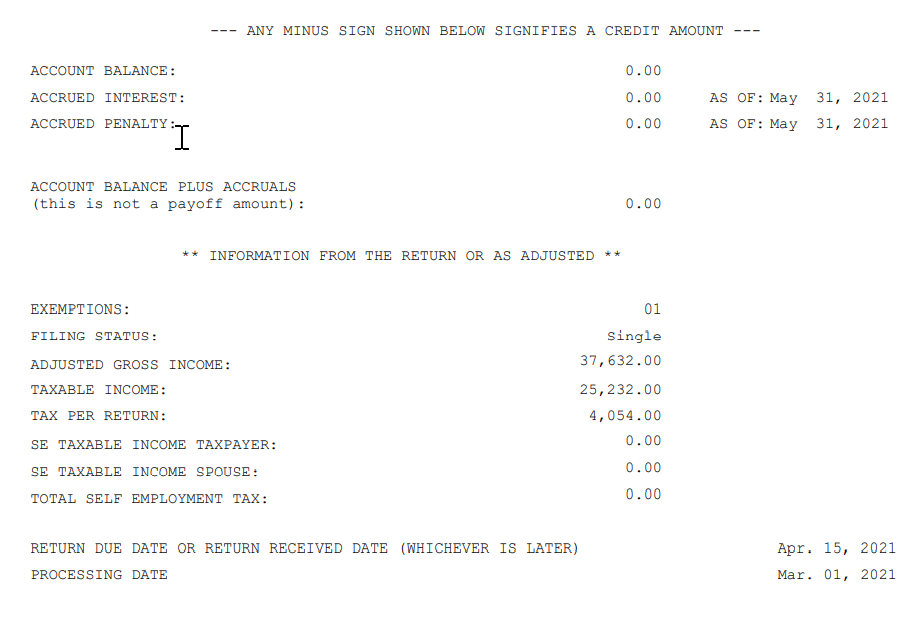

Special assessment taxes are only deductible when they are paid to fund maintenance or repairs Non deductible Special assessment taxes that increase the value of a property are added to a propertys cost basis. You can request Wage and Income Transcripts from IRS httpwwwirsgovIndividualsGet-Transcript and compare the numbers reported to IRS. As a general rule the IRS must assess additional tax and propose penalties no later than 3 years after either a tax return is filed or the returns due date whichever is later.

The IRS selects taxpayer returns for examination for a variety of reasons. 442514 Quick Assessment Verification Form 3552 CCP or Campus Examination Procedures. 79 rows Individual Master File IMF Audit Reconsideration is the process the IRS uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid or a tax credit was reversed.

The term additional assessment means a further assessment for a tax of the same character previously. An examination is the same thing as an audit. It is a further assessment for a tax of the same character previously paid in part.

The tax is charged. If youre actually being audited youll receive a. Examination cases closed as Non-Examined with no additional tax assessed do not meet the definition and criteria of an Audit Reconsideration.

An assessment is the recording of the tax debt on the books of the IRS. Additional assessment is a redetermination of liability for a tax. Title 54 - Taxation.

Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you owe. Additional Assessment Law and Legal Definition. A special assessment tax is a surtax levied on property owners to pay for specific local infrastructure projects such as the construction or maintenance of roads or sewer lines.

Upon assignment of a quiet amended return the examiner must make sure the additional tax has been assessed and if necessary make the assessment. The IRS characterized the 10000 fringe benefit amount as additional 2016 wages and assessed 4030 in total employment tax against the employer2500 for federal income tax 765 for the employers share of Federal Insurance Contributions Act FICA taxes and 765 for the employees share of FICA. In employment tax examinations where any worker classification issue was examined and accepted and other non-IRC 7436 issues are adjusted.

Immediately assess the additional tax reflected on it to insure that the Governments interests are protected. Contact the taxing authority if you need additional information about a specific charge on your real estate tax bill. The taxpayer may also face additional interests and penalties in addition to assessed tax liability.

It may be disputed. Examination of return report.

Revision Exercise With Key Notes O Level Poa Assessment Book Tuition O Levels Syllabus

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

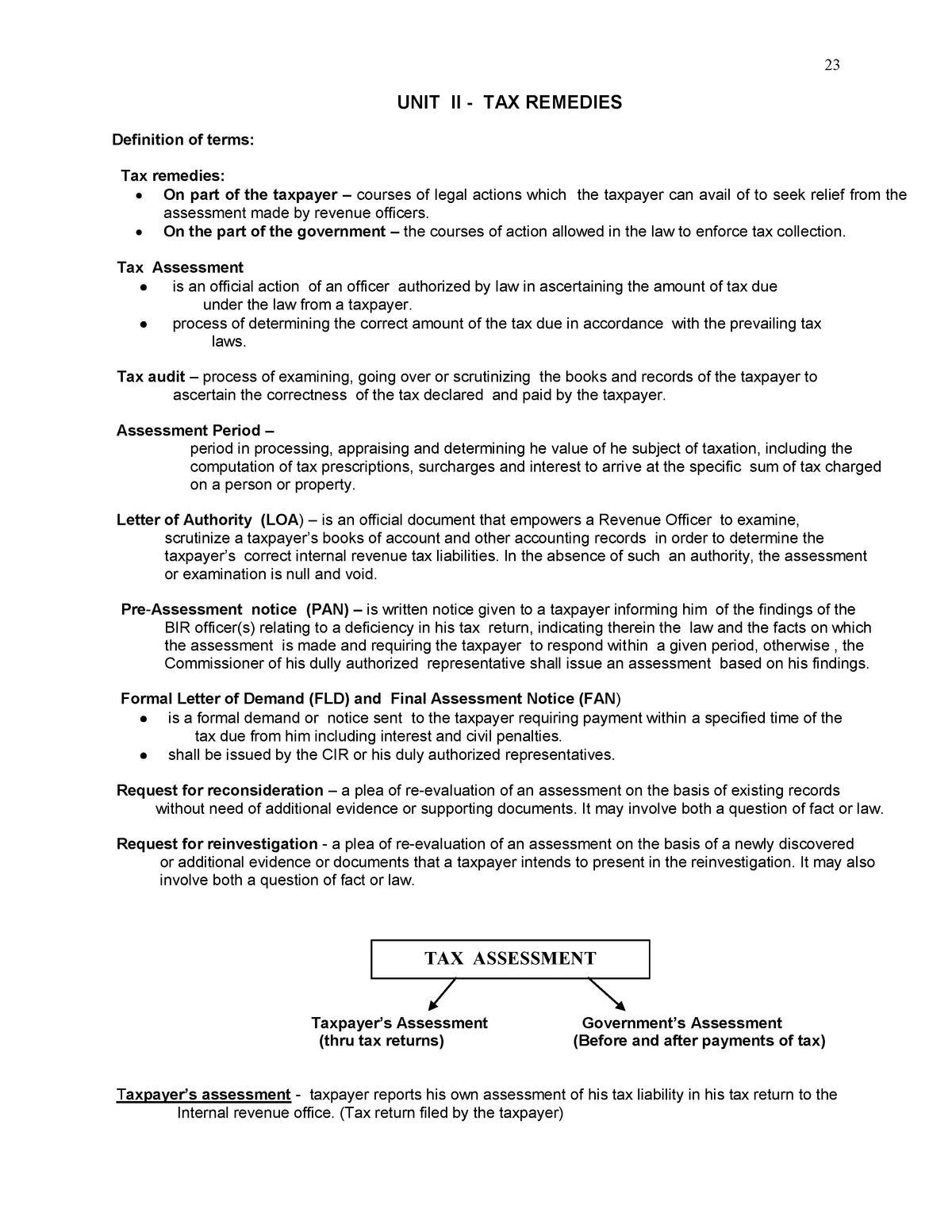

Unit Ii Tax Remedies Unit Ii Tax Remedies Definition Of Terms Tax Remedies On Part Of The Studocu

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

How To Read An Irs Account Transcript Where S My Refund Tax News Information

8 Improving Tax Compliance In Improving Tax Administration In Developing Countries

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

What To Do With Math Error Notice Letters From The Irs Journal Of Accountancy

What To Do With Math Error Notice Letters From The Irs Journal Of Accountancy

About Tutor Mr Wynn Khoo For More Information Contact Admin Poatuition Com Sg Http Www Poatuition Com Tel 81356556 Tuition Tuition Centre Tutor

/u-s-tax-filing-1090495926-21c69e6cc0ba4db0894841c99b26adbf.jpg)

Notice Of Deficiency Definition

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

The Official Guide For Gmat Quantitative Review 2017 With Online Questions Gmat Gmat Exam Writing Assessment

Australian Income Tax Legislation 2011 Income Tax Assessment Act 1997 Sections 1 1 717 710 Pdf Download Income Tax Childrens Education Income

Cbic Notifies Extension Of Due Date For Filing Gst Annual Return For Fy 2018 19 Due Date Indirect Tax Dating